Whether you’re buying or selling a house for the first time, there are a lot of things you need to get familiar with. Among other things, you have to learn some of the real estate terminologies in order to follow the process without issues. One of the terms that always come up in this process is escrow.

But what is escrow? We’ve all heard about it, but it doesn’t mean we all understand it. Don’t worry; it might sound more complicated than it is. That’s why we’re here – to explain the meaning of escrow and what it entails. So, if you’re a real estate novice and need some guidance, keep reading to find out more about escrow.

First Things First: What Is Escrow?

Let’s start at the very beginning – what is escrow in real estate?

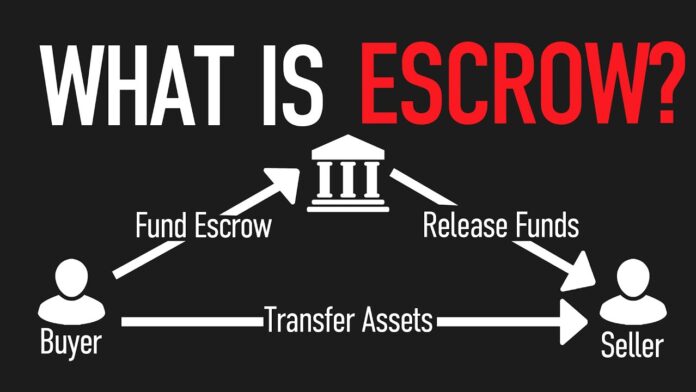

Escrow is a process where a third party, an escrow company like Lightspeed Escrow, holds and manages the deposit of earnest money and other documents until both the buyer and seller have fulfilled their contractual obligations. The escrow period typically starts when the offer is accepted and ends when the sale closes.

In real estate transactions, the buyer usually chooses the escrow company, but sometimes the seller can require a specific escrow company.

The Meaning of Escrow in Real Estate: Why Does It Exist?

In real estate, the escrow process is used to ensure that all the conditions of the sale are met before the deed to the property is transferred from the seller to the buyer. Essentially, it protects both the buyer and the seller in a real estate transaction.

The most essential document in any real estate transaction is the purchase agreement, which outlines all the conditions that must be met for the sale to go through. The conditions of the sale typically include things like a home inspection, appraisal, and loan approval.

By using an escrow company, both parties can be sure that the conditions of the sale will be met before any money changes hands. Once all the conditions have been met, the escrow company will disburse the funds to the seller and transfer the deed to the buyer.

For buyers, this means they won’t have to worry about losing their deposit if the sale falls through. On the other hand, the sellers won’t have to worry about the buyer backing out at the last minute.

How Escrow Works: Step by Step

The escrow process typically starts when the buyer and seller agree on the sale of a property. But what does this process entail?

Earnest Money Deposit

Once the sale agreement is in place, the buyer will deposit earnest money into an escrow account. The earnest money deposit (EMD) is a good faith deposit that shows the seller that the buyer is serious about the purchase.

Home Inspection

The next step is scheduling a home inspection. The home inspection is an important part of the escrow process because it gives the buyer a chance to have the property inspected for any potential problems. If there are any problems with the property, the buyer and seller will negotiate how to fix them. Before escrow closes, you can request that the seller fixes these potential issues.

Loan Application

Once the home inspection is complete, the buyer will apply for a loan. The loan approval process can take a few weeks, but once the loan is approved, the buyer has to provide proof of funds to the escrow company.

The escrow company will then order a title search to ensure the property is free and clear of any liens or encumbrances.

Closing Statement

Once the title search is complete, the escrow company will provide a closing statement to the buyer and seller. The closing statement outlines all the costs associated with the sale, including the purchase price, loan fees, transfer taxes, and other miscellaneous expenses.

The buyer and seller will sign the closing documents, and the deed to the property will be transferred from the seller to the buyer.

What Are Escrow Fees and Who Pays Them?

Escrow fees are part of the closing costs of buying or selling a property. They cover the costs of paperwork, fund distribution, and title company fees.

In most cases, the buyer and seller split the escrow fees evenly. However, there are some situations where the seller may be responsible for paying all the escrow fees. For example, if the buyer is obtaining a mortgage, the lender may require the seller to pay all of the escrow fees. In the same vein, sometimes it’s the seller who covers these fees.

Understanding all the fees associated with buying or selling a property is important, so there are no surprises at closing. Your real estate agent can help you estimate these costs and ensure they’re included in your offer.

How Long Is the Escrow Process?

The length of the escrow process can vary depending on several factors, but it typically takes 30-60 days to complete.

- The most significant factor affecting the escrow length is the loan approval process. If the buyer is obtaining a mortgage, the lender will need to order a home appraisal and verify the borrower’s income and employment history. This process can take several weeks.

- Another important factor is the home inspection. If the home inspection reveals any problems with the property, it can take some time to negotiate how to fix them.

- The final factor is the closing date. The closing date is when the deed to the property is transferred from the seller to the buyer. The closing date is typically set when the sale agreement is signed, but it can be extended if necessary.

Is Escrow a Good Idea?

While escrow can add some extra time to the home buying or selling process, it is worth having the protection that comes with it. This system ensures that all agreed-upon terms are met before finalizing the sale, which gives both buyers and sellers peace of mind.

If you’re considering buying or selling a property, be sure to work with an experienced real estate broker who can help you navigate the escrow process. They will be able to answer any questions you have and help make the process as smooth as possible.